Ultimate Guide to Financial Analytics For SMEs

Introduction – Why Financial Analytics Is No Longer Optional for SMEs

Small and mid-sized enterprises (SMEs) operate in an increasingly competitive and data-driven environment. While large organisations have long relied on advanced financial analytics to guide decisions, many SMEs still depend on spreadsheets and historical reports. This approach often leads to delayed insights, missed opportunities, and reactive decision-making.

Financial analytics enables businesses to move beyond static reports and gain real-time visibility into cash flow, profitability, and future performance. With modern ERP systems and cloud-based tools, SMEs can now access powerful analytics capabilities that were once available only to large enterprises.

In this guide, we explain what financial analytics is, why it matters, how it works, and how SMEs can successfully implement it to drive growth and stability.

What Is Financial Analytics?

Financial Analytics refers to the process of collecting, analysing, and interpreting financial data to support better business decisions. It helps organisations understand past performance, identify trends, and forecast future outcomes.

Financial Analytics vs Traditional Financial Reporting

Traditional financial reporting focuses on historical performance—income statements, balance sheets, and cash flow statements. These reports are essential but primarily answer the question: What happened?

Financial analytics goes further by answering:

- Why did it happen?

- What will happen next?

- What should we do about it?

This shift transforms finance from a reporting function into a strategic decision-making partner.

Financial Analytics vs Business Intelligence (BI)

Business intelligence tools analyze operational and customer data across departments. Financial analytics, however, focuses specifically on financial performance, budgeting, forecasting, and risk management. Finance teams require specialized metrics and models that go deeper into profitability, liquidity, and capital efficiency.

Why Financial Analytics Is Critical for SME Growth and Stability

SMEs often operate with tight margins and limited resources. Financial analytics provides the clarity needed to manage growth without increasing risk.

1. Improving Cash Flow Visibility and Control

Cash flow is one of the biggest challenges for SMEs. Financial analytics helps monitor receivables, payables, and working capital in real time, allowing businesses to anticipate shortages and take corrective action early.

2. Supporting Accurate Forecasting and Budgeting

Forecasting based on historical averages is no longer sufficient. Analytics tools use trends and real-time data to produce more accurate forecasts, helping businesses allocate resources effectively and avoid budget overruns.

3. Reducing Financial Risk and Uncertainty

Financial analytics enables scenario modeling—testing how changes in costs, demand, or pricing affect profitability. This allows decision-makers to evaluate risks before committing to major investments or operational changes.

Types of Financial Analytics Every SME Should Understand

Financial analytics can be categorized into four main types, each serving a different purpose.

1. Descriptive Financial Analytics

Descriptive analytics summarizes historical data through reports and dashboards. Examples include monthly profit reports and revenue trends.

2. Diagnostic Financial Analytics

Diagnostic analytics examines underlying causes. For instance, analyzing why expenses increased or why margins declined in a specific period.

3. Predictive Financial Analytics

Predictive analytics uses historical data and statistical models to forecast revenue, cash flow, and demand trends.

4. Prescriptive Financial Analytics

Prescriptive analytics provides recommendations, such as adjusting pricing, optimizing inventory, or reducing operational costs to improve profitability.

Key Financial Metrics and KPIs for SME Decision-Making

Tracking the right financial metrics ensures that analytics efforts translate into actionable insights.

1. Core Profitability and Cost Metrics

Key indicators include gross margin, operating margin, and cost-to-revenue ratio. These metrics help businesses understand efficiency and identify areas where costs can be reduced.

2. Cash Flow and Working Capital Metrics

Cash conversion cycle, receivables aging, payables aging, and inventory turnover provide visibility into liquidity and operational efficiency. Monitoring these metrics helps prevent cash shortages and improve working capital management.

3. Forecasting and Planning Metrics

Budget variance, forecast accuracy, and scenario sensitivity are essential for evaluating planning effectiveness. These metrics enable businesses to refine forecasts and improve financial discipline.

Financial Analytics in ERP Systems – How It Actually Works

Modern ERP systems integrate financial data from multiple departments into a centralized platform, enabling real-time analysis.

1. Data Sources Within an ERP System

Financial analytics draws data from sales, purchasing, inventory, and accounting modules. This integrated approach eliminates data silos and ensures consistency.

2. Real-Time Dashboards and Financial Visibility

Dashboards present key financial indicators in visual formats such as charts and graphs. Decision-makers can quickly identify trends, monitor performance, and take action without waiting for month-end reports.

3. Scenario Modeling and Forecast Simulations

ERP-based analytics tools allow businesses to simulate different scenarios—such as changes in demand or cost fluctuations—to understand their financial impact before making decisions.

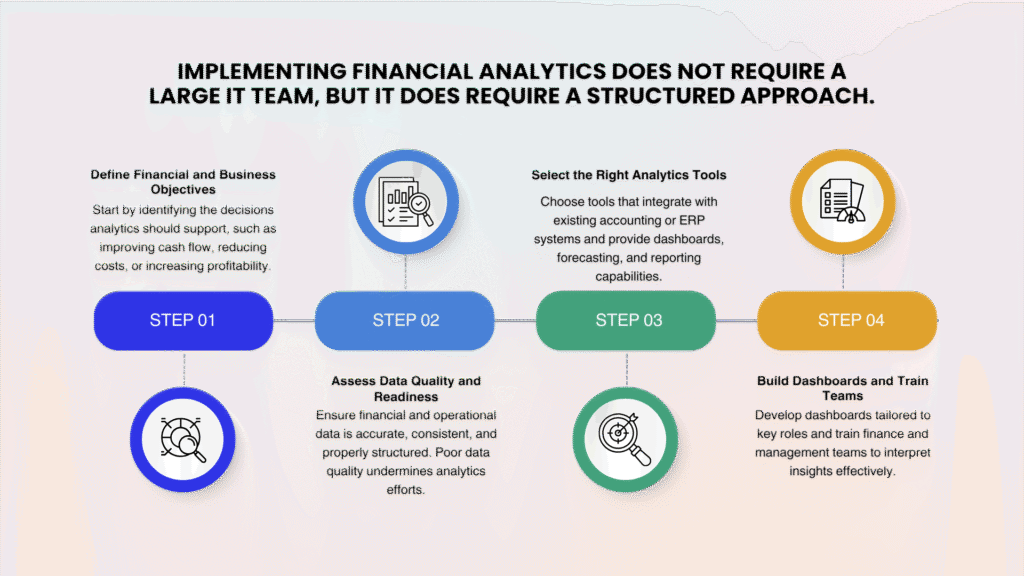

Step-by-Step Financial Analytics Implementation Roadmap for SMEs

Real-World Use Cases of Financial Analytics by SME Industry

Different industries use financial analytics in different ways.

1. Manufacturing and Distribution Businesses

Manufacturers use analytics to monitor production costs, optimize inventory levels, and analyze supplier performance.

2.Retail and Trading Businesses

Retailers rely on analytics to track product margins, forecast demand, and manage seasonal fluctuations.

3.Professional Services Firms

Service-based businesses use financial analytics to evaluate project profitability, monitor billable utilization, and control overhead costs.

Common Challenges SMEs Face with Financial Analytics

While the benefits are clear, many SMEs encounter obstacles during adoption.

1.Data Silos and Manual Processes

Disconnected systems and manual data entry lead to inconsistent reporting. Integrating financial and operational data into a single system resolves this issue.

2.Lack of Financial Analytics Expertise

Finance teams may not be familiar with analytics tools. Training and simplified dashboards can bridge this gap.

3.Change Management and Adoption Issues

Employees may resist new processes. Demonstrating quick wins and involving stakeholders early helps improve adoption.

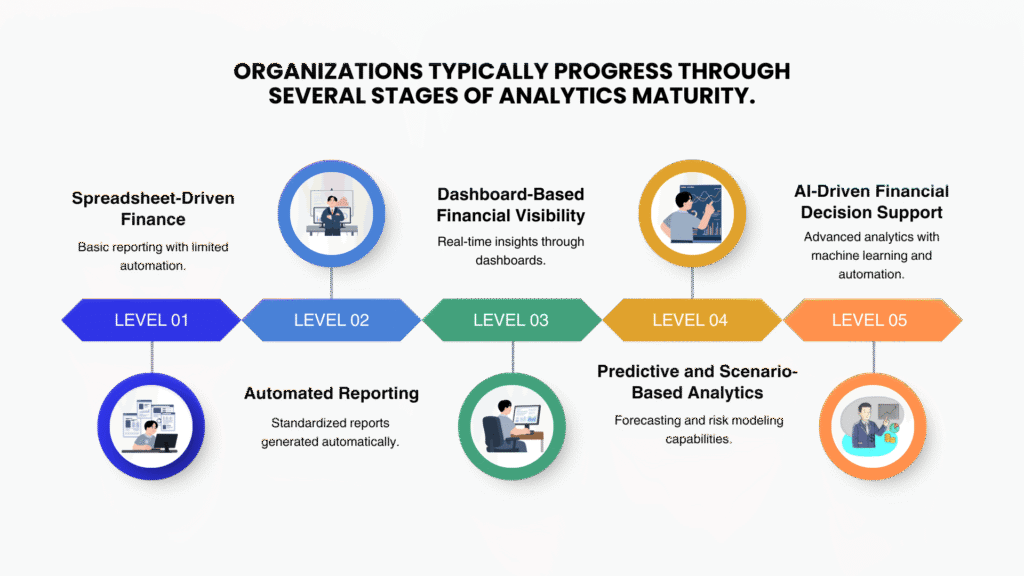

Financial Analytics Maturity Model for SMEs

Future Trends in Financial Analytics for SMEs

Financial analytics continues to evolve rapidly.

1.AI and Machine Learning in Financial Forecasting

AI-powered tools can analyze large datasets and identify patterns that traditional methods might miss, improving forecast accuracy.

2.Embedded Analytics Inside ERP Systems

Analytics capabilities are increasingly built directly into ERP platforms, making insights accessible without separate tools.

3.Real-Time, Always-On Financial Decision Making

As cloud technologies mature, businesses can monitor financial performance continuously and respond instantly to changing conditions.

Conclusion – Turning Financial Data into Strategic Advantage

Financial analytics empowers SMEs to move from reactive reporting to proactive decision-making. By gaining real-time visibility, improving forecasting accuracy, and identifying risks early, businesses can achieve greater financial stability and sustainable growth.

The journey begins with clear objectives, reliable data, and the right tools. SMEs that invest in financial analytics today will be better prepared to navigate uncertainty and seize new opportunities in the years ahead.